In contrast, the company has hired 2 project managers who will receive a wage and in addition a severance package once the project is accomplished. The cost of this severance package deal is estimated to be $65,000 in whole and the corporate has created a liability called “Severance to be Paid”. Even though the payment hasn’t been made yet the corporate is anticipating it and incorporating its impression on its liabilities to extend the accuracy of its monetary reviews.

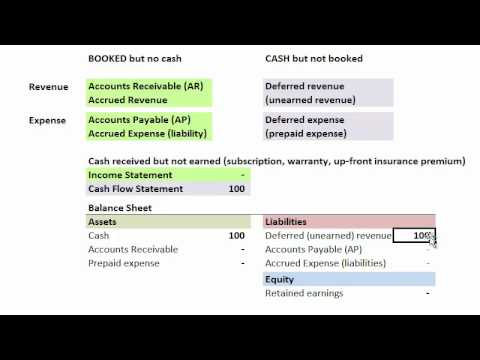

When you notice accrued revenue, you’re recognizing the quantity of revenue that’s due to be paid however has not but been paid to you. You would recognize the revenue as earned in March after which report the cost in March to offset the entry. Accruals are when cost happens after an excellent or service is delivered, whereas deferrals are when payment happens before an excellent or service is delivered. An accrual will pull a present transaction into the current accounting interval, but a deferral will push a transaction into the next interval. Accruals and deferrals have a big influence on financial statement evaluation. Accurate timing in income recognition is crucial for controlling and understanding your business’s financial efficiency.

Similarly, bills are recognized in deferral accounting when cash is paid, rather than when they’re incurred. This may find yourself in a mismatch between bills and the income they help generate, making it difficult to evaluate the true profitability of a business. By focusing solely on cash actions, deferral accounting may not present an correct representation of an organization’s monetary performance. A frequent example is when a buyer pays upfront for goods or services that haven’t yet been delivered.

Why Are Accruals And Deferrals Necessary For Correct Monetary Reporting?

By following this principle, companies can provide a extra accurate illustration of their financial performance by aligning revenues with related bills. To illustrate, consider an organization that receives an annual rent payment in advance. This cost is a deferral, recorded as a liability (unearned revenue) on the steadiness sheet. As the months move and the company earns the lease by offering space, it recognizes a portion of this fee as income each month. Companies usually use accrual accounting when they want to precisely characterize their monetary efficiency over a period, especially when revenues and expenses don’t align with money flows.

What Are The Variances Between Accrual And Deferral Accounting Methods?

This cash inflow is initially recorded as a legal responsibility on the stability sheet under ‘deferred income’ and solely recognized as revenue when the product or service is definitely supplied. Accrual is an accounting method the place firms report income and bills as they’re earned or incurred, not when money changes hands. Sure accounting ideas are typically utilized in any company’s revenue and expense recognition principle. These are adjusting entries, known as accrual and deferral accounting, utilized by businesses often to adapt their books of accounts to reflect the correct picture of the company. The importance of the matching principle can’t be overstated in accrual accounting. This principle states that bills should be recognized in the identical interval as the income they assist generate.

For instance, if you’ve accomplished a service or issued a mortgage and anticipate an interest payment to reach later, you can record the expected quantity as accrued revenue for the current accounting period. So, when you’re prepaying insurance coverage, for example, it’s typically acknowledged on the balance sheet as a present asset after which the expense is deferred. The amount of the asset is usually adjusted monthly by the amount of the expense.

Invoices that require an accrual are identified by Disbursement Services when the invoices are processed for cost. A copy of the invoice is forwarded to the Accounting Department to create the journal entry to acknowledge the expense and the legal responsibility (accrued expense). Enterprise Managers should review their preliminary month-to-month shut report to make sure that all bills for have been properly acknowledged within the current fiscal year. Business Managers should notify the Accounting Division of any money owed to the College for providers that had been rendered prior to the tip of the year. The Accounting Department will also e-book a receivable and acknowledge income for cash receipts that observe the delivery of goods/services and trade of cash as explained above. A widespread instance of accounts receivable are Contribution Receivables for pledges made by donors.

Deferrals help make certain financial statements show what happens in specific durations more precisely. This delay keeps observe of actual obligations and assets available inside these timesframes without misrepresenting financial positions. The identical goes for expenses—they are recognized when a company incurs them somewhat than when it pays out cash. A construction firm has received a contract to construct a sure road for a municipal government and the project is predicted to be concluded inside 6 months. The firm has received a $500,000 cost in advance that ought to cowl 25% of the project’s value and the accounting division has to ensure this transaction is handled appropriately. An instance of a deferral would be an annual insurance coverage premium that’s paid in full at the beginning of the year but the expenses is deferred on a monthly basis all through the whole 12 months.

It is the premise for separate recognition of accrued expenses and accrued incomes in the financial statements of a business. The accruals idea of accounting requires companies to report incomes or bills after they have been earned or borne quite than when they’re paid for. In budgeting, correct timing of accruals and deferrals can influence financial reporting. For instance, a company might have to regulate income recognition to match expenses incurred or defer earnings for tax planning functions.

- It’s common for companies and clients to prepay or pay later for goods and companies.

- Deferrals assist ensure financial statements show what happens in specific durations more precisely.

- When the bill is acquired and paid, it will be entered as $10,000 to debit accounts payable and crediting money of $10,000.

If the corporate prepares its financial statements in the fourth month after the warranty is bought to the purchasers, the corporate will report a deferred earnings of $4,000 ($6,000 – ($500 x 4)). Equally, the company will report an income of $2,000 ($500 x 4) for the interval https://www.simple-accounting.org/. In the following interval of reporting, the steadiness sheet of ABC Co. will not report the accrued earnings in the stability sheet as it has been eradicated. The earnings of $1,000 for the period won’t be reported within the revenue assertion for the next interval as it has already been acknowledged and reported. The examples under set out typical bookkeeping journal entries in relation to accruals and deferrals of revenue and expenditure.